After an exhausting year of chasing – and missing out – on new homes, buyers are starting to cool down their search in the run- up to Christmas.

While auction houses are fully booked – this week alone, Barfoot & Thompson has 420 auctions scheduled in Auckland, with more in Northland – and vendors are keen to get listed, buyers have run out of steam.

Bayleys Blair Haddow, who last week had five bidders fighting for an architect-designed Westmere house that sold under the hammer for $6.2 million, said the appetite for buying and selling sure changed in December, and that an auction last week was unusually late for his market.

“People will just evacuate the city, I think. And people are just not sure about January, there [is] a lot just pausing.

Start your property search

“You never really know what the market is doing until Waitangi Day, when the stock comes on, but we’ve already listed a number of properties around the $2m to $4m for then.”

Steve Koerber, of Ray White Remuera, said he too had noticed a real drop- off in attendances at open homes and viewings this weekend, as buyers head to the malls and newly -opened restaurants instead.

“When they say ‘what will I do in the weekend’, they’re not looking at houses,” he said.

The property on Rue D'Amarres, Gulf Harbour, has its own marina berth. Family buyers from the city are moving to the Whangaparoa Peninsula for year round lifestyle. Photo / Supplied

“They know there’s more stock coming in January and February. I’ll usually have a full schedule of campaigns starting from February 7 [after Waitangi weekend] but this year, it’s January 24 or 31.

“People want to get the jump, there’s a fear factor that prices might fall. If we’re looking at 100 listings this January, versus 50 last year then prices won’t go up.”

Ray White agent Mike Robson said while he felt the media sometimes drove the market, “people are buying into the negative stories.”

“Buyers are aware there’s not the frenzy to buy, that they’re not under pressure because of lack of stock. Lockdown delayed the usual September/October spring rush, but if they wait another month or two they’ll see a lot more property,” Robson said.

“There’s a glut of stock, buyers are aware of that and so are vendors.”

He added that vendors were now keen to get into the market to capitalise on their property’s higher value before what he called a “slight drift down” in the next three or four months. And unlike much of this year, most now plan to sell before they buy.

A buyer sealed the deal on this Victoria Avenue mansion last week, paying $19.5m. Photo / Supplied

Robson added that while buyers were fatigued at looking after three or four months, sellers were keen to get back into the market, with listings coming on stream as early as January 5 for late January auctions, rather than waiting until the usual February start.

“People are not travelling to Europe, they’re staying close to Auckland, and are coming back earlier. It’s a great time to buy, and some people are waiting a bit longer.”

Fellow Ray White agent Heather Walton, who owns offices in both Epsom and Matakana, said buyers were “still going” so she was telling vendors to go now too, bringing properties to auction as early as January 20 next year.

“Every year it’s the same, it goes quiet around Christmas and then starts again December 27. If you keep the phone on, it keeps ringing all through the holidays.

“Couples have time to chat to each other, they may go back and re-look at places they passed over last time.

“This year will be a bit different; people aren’t going to Europe to ski and then there’s the January influx with changes to MIQ rules. The agents who keep their phones on will do the business.”

A pre-auction offer knocked out other bidders for a house on Ngapuhi Road, Orakei, that sold for $3.9m on Friday. Photo / Supplied

As the Real Estate Institute of New Zealand reported record median prices and sales volumes, along with an up-tick in new listings in most of the country for November, Chief Executive Jen Baird, said the market had settled back into its stride and was returning to business as “near-usual.”

“FOMO — fear of missing out — is beginning to dissipate. The enduring strength of property prices means some vendors may be less inclined to act now, without fear of missing their preferred prices later,” she said.

“While the supply versus demand imbalance continues to push prices upwards, [increased] inventory levels [are] providing buyers more choice and giving reluctant sellers confidence that if they take their current property to market, they will be able to buy their next one.”

UP Real Estate co-owner Barry Thom said that the “glut and deluge” of new listings that started in November meant that “the hit rate went down and buyer interest got very thin.”

He said that buyers who had left the market were now starting to circle around and wanted to purchase before Christmas. Vendors, on the other hand, were planning to get listings to the market when people were back in town around January 15.

“The jury’s out on what January will bring, but we expect to take off reasonably early, we’ve got a huge inventory of new stock.

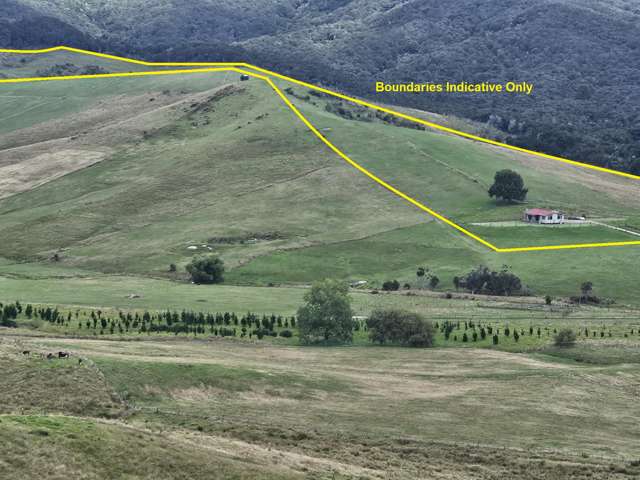

“Lifestyle property will really take off. We have a property at Gulf Harbour with its own marina that will be on the market through January, these places don’t come up very often and there are people looking to get out of Auckland.”

UP agent Mark Wilson, who is listing the Rue D’Amarres property, said that nearly all his buyers were Auckland families from the eastern suburbs heading north for the lifestyle, and they would keep looking through the holidays.

Luxury agent Michael Boulgaris, who last week inked the $19.75m sale of a luxuriously made over grand mansion on Victoria Avenue, Remuera, agreed that when buyers spot an interesting property they’ll move.

“Whether they’re overseas or in MIQ, they’re rats to a drain. If it’s the property of their dreams, they’ll call.”

Boulgaris added that savvy vendors were listing this side of Christmas, not waiting until the January re-start.

“These are successful people, they don’t put off until tomorrow what they can do today. They want to snag that one buyer today, not find that their neighbour’s listed a similar property and got that buyer instead.”